Please click here for the detailed PDF version of the group risk administration guide.

Risk benefits provide vital financial protection and are a key part of an individual policyholder's Financial Wellness. Given the stressful circumstances under which these benefits are often paid, Momentum strives to deliver excellent service and make payment as soon as possible. In order to achieve this and make a difference in a policyholder's life when they need it most, we need to work closely with you.

This Guide outlines the processes required for the efficient administration of your employees’ risk benefits. Expected turnaround times are also shared.

Please read this guide in conjunction with your Scheme Policy to see which benefits apply to your Scheme.

| Service Request | Turnaround Times (working days) | Your responsibility |

| Accidental Disability Claims | 10 days | Please submit:

|

| Annual data collection and medical underwriting requirements | 3 days | Please submit the salary schedule (preferably electronically), including the member class and dependency status (if applicable). Please submit any outstanding exit claim forms. |

| Annual rate reviews and any ad hoc rate reviews | 3 days | Please provide the relevant detail related to your choice of benefit in writing. |

| Banking and allocation of premiums | 48 hours | Policy premiums must be paid monthly in arrears on the last day of the month (i.e. at the end of each month in which they are due). Please email proof of payment, with the scheme reference number. In addition, please email supporting data advising of member changes, such as new members or member exits. Ensure risk salaries are included. If available, member’s cellphone numbers and email addresses should be supplied so that we can contact them when necessary. |

| Changes to existing contracts | 10 days | Please complete and submit a New Business and Benefit Change Application document/Form. |

| Children’s Education benefit | 5 days | Please submit:

|

| Continuation Assurance Option | 24 hours | Member’s name (initial and surname), date of birth, date of exit and salary at date of exit. |

| Critical Illness assessment | 2 days | Please submit:

|

| Critical Illness claim | Payment will be made within 5 days | |

| Death claims (all cases) | 5 days | Please submit:

N.B. An abridged handwritten death certificate is not acceptable. Please submit a copy of the BI 1663 document / DHA 1663A. N.B. If no documents are available, the death notification must include full names, date of death & salary at date of death. Momentum must be notified of the death within 6 months from date of death. NB: Ensure that the salary at date of death and banking details are completed on the claim form. |

| Death claims (taxable cases) | Payment will be made within 2 days of receipt of a tax directive | |

Disability claims (monthly & lump sum) assessment |

10 days | Please submit:

|

| Disability claims payments - lump sum (once the claim is admitted and after the expiry of the waiting period) | 5 days | |

| Disability claim payments - monthly income ( once the claim is admitted and after the expiry of the waiting period) | Initial payment - 6 working days. Thereafter monthly as agreed between the member and Momentum | |

| Disability review | 10 days | Please submit:

|

| Existing business quotations | 4 days | You or your broker must submit:

|

| Funeral claims (all cases) | 48 hours | Please submit:

|

| General queries | 48 hours | Email your Scheme Risk Administrator. |

| Issuing of new legal contracts and endorsements | 10 days | Please submit a completed New Business and Benefit Change Application document, including the Policyholder Protection Regulation requirements. |

| New business installations | 10 days | You or your broker must submit:

|

| New business quotations | 5 days | Please provide your broker with:

|

| Termination of existing benefits | 30 days | Please provide one month’s written notice to terminate benefits. We would appreciate a reason for the termination and details of the new insurer, if applicable. Any underpayment will be due following a final reconciliation of premiums. |

|

||

For your policyholders to enjoy the risk benefit, it is important that policy premiums are be paid at the end of each month in which they are due.

Your scheme Risk Administrator or Momentum Consultant will provide you with the banking details.

Your policyholders can be left vulnerable if payments are delayed as the scheme cover could be placed on hold.

To offer you and your policyholders the best possible service, we rely on you the member to provide us with accurate, up-to-date membership and salary data. This is vital for effectively administering your scheme, and particularly critical during the scheme’s annual rate review.

For your employees to enjoy the risk benefit, it is important that policy premiums are be paid at the end of each month in which they are due.

Your scheme Risk Administrator or Momentum Consultant will provide you with the banking details.

You employees can be left vulnerable if payments are delayed as the scheme cover could be placed on hold.

As part of our service promise, it is important to us that new and eligible policyholders are covered as soon as possible. Your scheme policy outlines the eligibility conditions.

For your employees to enjoy the risk benefit, it is important that policy premiums are be paid at the end of each month in which they are due.

Your scheme Risk Administrator or Momentum Consultant will provide you with the banking details.

You employees can be left vulnerable if payments are delayed as the scheme cover could be placed on hold.

If you want to make any changes to your scheme’s risk benefits, please send in writing, either directly to Momentum or via your financial advisor.

The reason why you provide risk benefit to your policyholders is to enhance their Financial Wellness. However things can go wrong at claims stage if the required documents are submitted late or incomplete. To ensure that the complete claiming process runs effectively please make sure that the forms submitted are correct and signed. Please also ensure that all supporting documentation and forms are not submitted late.

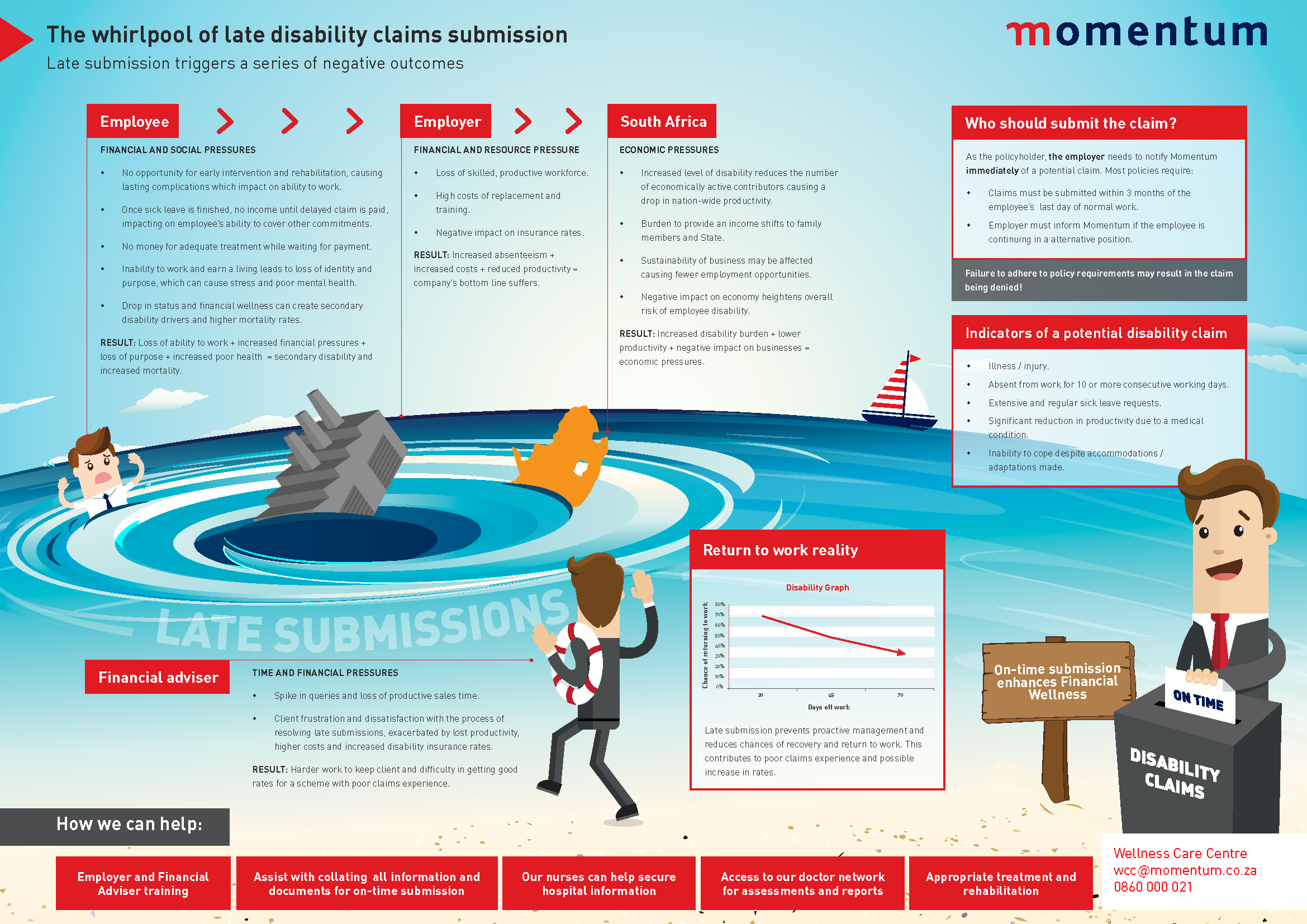

As the policyholder, the employer needs to notify Momentum immediately of a potential disability claim. Late submission could whirlpool into negative outcomes. The sooner we know about the claim, the sooner our Wellness Care Centre can intervene and respond with appropriate treatment and rehabilitation in the interest of your business’ Financial Wellness and that of the affected policyholders.

Take note of the ripple effect that may be caused by not submitting your claim on time.

This benefit pays a lump sum if a member is diagnosed with a critical illness or event, such as a stroke, blindness, cancer, kidney failure, heart attack, paralysis, heart surgery, major organ transplant, etc. If he claim is approved, the benefit is paid in terms of your scheme’s policy. Again, our Wellness Care Centre needs to be notified immediately.

Part of members Financial Wellness journey is ensuring their children’s educational needs are covered should they die. Please ensure also that all correct documentations are submitted.

A policyholder's death is not only traumatic for family members, but can create financial strain for dependants while pay cut of benefits are being finalised. To ensure death benefits are paid as quickly as possible, please provide written confirmation of a death claim within six months of the member’s death, together with the information listed in the admin guide.

To enable family members to give their loved one a dignified funeral, we strive to pay funeral benefits within 48 hours of receiving the claim documents. Please assist us by ensuring that all claim documents are submitted as soon as possible following a policyholder’s death. Incomplete or missing information will delay the payment of the benefit, and can cause unnecessary stress.

This benefit provides invaluable support to policyholders and their immediate families, including the spouse, children, parents and parents-in-law, in their time of need. For example:

If your policy includes the Conversion option, policyholders who leave your scheme may take out an individual life and disability benefit policy with Momentum as defined in the scheme policy. This option must be taken up within 90 days of the policyholder leaving the scheme.

If you are unhappy with the service you have received, we will make sure that the problem is resolved by following our complaints resolution procedure as stipulated on the admin guide

We strive to provide you and your policyholders with excellent service.

Please click here for the detailed PDF version of the group risk administration guide